GET TO KNOW US

Learn how CashTech's 40 years of experience is changing

how North America manages cash handling and payment processing.

Cash Management Bundles Overview

Get a turnkey solution for cash management with CashTech’s all-in-one hardware, software, service support, and training.

A BETTER BANK SERVICE SOLUTION: BEST-IN-CLASS SERVICE DELIVERY

Bank CFOs and COOs should embrace opportunities to reduce costs and enhance the customer experience. All-branch service is the better bank service solution that offers best-in-class service delivery for all your bank peripheral needs.

DOWNLOAD GUIDE NOWRETAIL SOLUTION BROCHURE

Learn how our PRECISION methodology helps our retail clients decrease cash handling costs and optimize cash flow.

DOWNLOAD BROCHURE NOW-

Magner S-75

Money - Currency Counter

Optimizing performance and productivity, the Magner S75 money counter offers a wide range of features and options to meet your needs.

LEARN MORE -

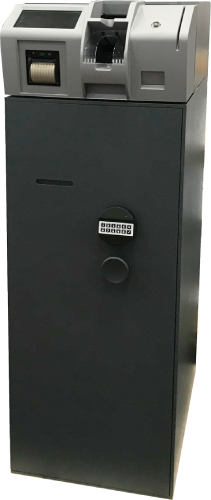

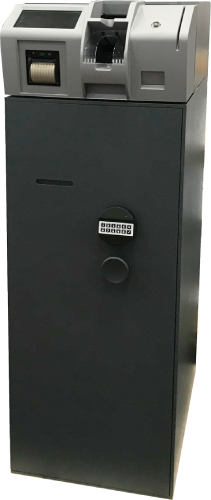

CIMA SDM500 Series

SMART DEPOSIT SOLUTION

With the latest High-Speed Smart Deposit Solution, you will process deposits fast,while ensuring note processing accuracy and reducing the risk of robbery.

LEARN MORE -

SUZOHAPP RCS-700

Banknote and Coin Recycler

The SUZOHAPP RCS-700 Cash Recycling Solution fully automates your cash handling, allowing you to retrieve real-time cash flow data from your computer or mobile device whenever you need it, for optimal visibility and smarter decision making..

LEARN MORE -

Tidel Series 4

Smart Safe

The Tidel Series 4 smart safe helps retail organizations effectively manage their cash deposits while adapting to the ever-changing needs of their business.

LEARN MORE

-

Magner S-75

Money - Currency Counter

Optimizing performance and productivity, the Magner S75 money counter offers a wide range of features and options to meet your needs.

LEARN MORE -

CIMA SDM500 Series

SMART DEPOSIT SOLUTION

With the latest High-Speed Smart Deposit Solution, you will process deposits fast,while ensuring note processing accuracy and reducing the risk of robbery.

LEARN MORE -

SUZOHAPP RCS-700

Banknote and Coin Recycler

The SUZOHAPP RCS-700 Cash Recycling Solution fully automates your cash handling, allowing you to retrieve real-time cash flow data from your computer or mobile device whenever you need it, for optimal visibility and smarter decision making..

LEARN MORE -

Tidel Series 4

Smart Safe

The Tidel Series 4 smart safe helps retail organizations effectively manage their cash deposits while adapting to the ever-changing needs of their business.

LEARN MORE

Have you ever stopped to determine the cost of handling cash?

Take a few minutes to find out using this free Cost of Cash Calculator.

Use the Calculator

Free Download

Services You Should Expect From Your Cash Management Solutions Provider

Take control of your cash management process and make some guided, well-informed decisions that will help increase your bottom line.

Get My Copy

Case Study

How We Helped a Casino Remove Cash Management Costs through Automation

Download this case study to learn how we helped a casino remove costs associated with managing cash through automation.

VIEW CASE STUDY

Free Download

A CFO's Guide: How Cash Handling Is Affecting Your Bottom Line

Read this white paper to learn more about the cost of cash handling and find out how your business can benefit from cash management solutions.

Get My CopyCashTech Complete Cash Management Package

Hardware

Choose from a variety of smart safe and cash recycler hardware options.

Software

Track, manage, and understand your cash with cash management software.

Service Support & Training

End-to-end service support, installation, training, and maintenance ensures your technology runs efficiently.

Sophisticated Solutions

Cash still accounts for over 50% of all purchases, according to a Bank of Canada survey. Discover how we bring together a broad range of cash counting, cash recycling, and cheque scanning equipment from global manufacturers like G&D, Magner, Digital Check, and Panini, and use our 40 years of cash management experience to help you make the right choice to achieve your business goals.

Cash Solutions

We offer the broadest array of commercial cash counting, sorting, and recycling equipment, including G&D and Magner, and to ensure you get the right product for your needs.

Learn More

COIN SOLUTIONS

Quick and accurate counting, sorting, and wrapping of coins is an essential part of your cash management process. Let us help you eliminate costly errors and save time.

Learn More

CHEQUE SOLUTIONS

We carry bank authorized and approved cheque scanning equipment by Digital Check, Panini, and Canon so you can conveniently get cheques deposited quickly and reduce the time and labour associated with frequent trips to the bank.

Learn More.jpg?width=179&height=200&name=RCS-700_RCS-Active_sm%20(1).jpg)

CASH AUTOMATION SOLUTIONS

Improve the efficiency and accuracy of your cash management process. Automate your cash drawer preparation, bank deposits management processes, and achieve the greatest return on investment by reducing labour, streamlining cash room procedures, and increasing cash flow.

Learn MoreBanks & Credit Unions

Banks & Credit Unions

We are proud to service all of the "Big Five" banks in Canada, as well as prominent banks across the US. Banks and credit unions have realized the importance of cutting the costs of handling cash and cheques, streamlining operations, and enhancing the client experience.

Learn MoreCasinos & Gaming

Casinos & Gaming

We offer a wide range of cash management solutions that quickly and accurately count, sort, and authenticate banknotes and TITO tickets and help reconcile the day’s sales for casinos and gaming operations. We have successfully helped casinos significantly reduce costs in managing cash operations in the front of

Armoured Transport

Armoured Transport

We offer a wide range of equipment that safely and securely count, process, and deposit notes and coins for retailers of all sizes. Your business can reduce the time and effort it takes for employees and managers to manage cash counting, sorting, and reconciliation and increase your cash flow.

Learn MoreRetail

Retail

We offer a wide range of equipment that securely counts, processes, and deposits notes and coins for retailers of all sizes. Your business can reduce the time and effort it takes for employees and managers to manage cash counting, sorting, and reconciliation and increase your cash flow.

Learn MoreEntertainment

Entertainment

We work with large entertainment facilities, cinemas, amusement parks, and zoos to accurately count, sort, and safeguard their cash and coin revenues. The cost-effective solutions we offer improve operational efficiencies and streamline business operations with best-in-class ROI strategies.

Learn MoreSERVICES WE PROVIDE

Lifecycle Management

When it comes to product lifecycle management, it’s about more than just acquisition and deployment. We help every step of the way.

Asset Management

Your assets are the lifeline to your business operations. We can help track these assets from deployment through to end of life, ensuring real-time reporting and on-demand views of install base and portfolio reviews.

Project Management

We provide sourcing, purchasing, deployment, installation/implementation, and equipment recycling services. This is ideal for customers who are implementing multi-location projects and require assistance with coordinating equipment delivery, installation, and training.

Extensive Reporting Capabilities

Excellent reporting is based on excellent data. CashTech has implemented processes and systems to ensure excellent data. Our incident management system operates in real time and can support real-time reporting and event management.

Support & Maintenance

Servicing and repairing equipment is a core competency of CashTech. We provide both depot and onsite break-fix and swap service with a reputation to always meet service level agreements while ensuring the continuous satisfaction of our customers.

Deployment Services

CashTech can receive and store client inventory in our warehouse for immediate or future deployment. We can receive units and begin the process to asset tag and perform quality assurance testing on each unit. We can ship to client’s end-user locations in Canada and the US.

"The CashTech solution has exceeded our expectations. The solution is easy to use and employees adapted quickly to the new technology. Most importantly, CashTech delivered on the savings. We reduced labour across our estate and eliminated four full-time employees. The results speak for themselves and we couldn't be happier."

- Greg Chamberlain, Manager of Cashiering and Casino Credit, Caesars Windsor

.png?width=117&height=117&name=cashtech-currency-logo%20(1).png)